Is Brigit legit?

What is Brigit? And is it the right money app for you?

So you’re looking for a money app that works for you. Smart. It’s 2023. Making budget spreadsheets is out. Let the robots do it for you.

And it’s not just budgeting that a money app can help you with. Many apps offer instant cash features, for when you’re in a tight spot, as well as help with building credit.

When it comes to finding the right money app for you, it makes sense to want to ensure the one you choose is legit. It’s obviously super important to do a little research to make sure that your money is safe, there are no hidden fees, and you’re not being scammed. Let’s start with Brigit.

Is Brigit legit?

Brigit is a legitimate money app. Brigit was founded in 2017 in New York by co-founders Zuben Mathews and Hamel Kothari.

It has been in business for six years and has over 3 million users.

The app also has over 200,000 reviews on the App Store.

How does the Brigit app work?

Brigit offers three main features. One of these is free, and the other two come with a monthly membership cost. To access these features, you need to connect your bank account. If you’re worried about how safe this is, scroll down - we’ve got it covered.

Let’s break these features down.

Brigit’s free Finance Helper tool

With Brigit’s free feature, you can:

Access a free financial insights tool

Track your spending

Access category breakdowns on your spending

Brigit’s Instant Cash feature

Here’s the lowdown:

Brigit offers a cash advance of between $50-$250

This money arrives on the same day if you apply before 10am EST. Otherwise, it’ll be the next business day

To access the cash advance, you have to sign up for Brigit’s paid plan, which is $9.99 a month

Brigit’s Credit Builder feature

Brigit’s Credit Builder feature costs $9.99 a month

With this product, you build a positive payment history to improve your credit score

Is Brigit safe?

Yes, Brigit states on its website that it secures all of your data with the same 256-bit encryption that big banks use.

Brigit uses your bank account details to analyze your expenses and recurring deposit history. With this information, Brigit is able to provide financial services it offers, such as the financial helper tool and Cash Advance.

How to delete the Brigit app

Decided Brigit isn’t right for you? Here’s how to delete your Brigit account in four simple steps.

1. Log in to your Brigit account on hellobrigit.com

2.Once you've logged in, head to Settings

3.Click Delete my account

4.Confirm you want to delete

Have a Plus membership? Here’s how to cancel it.

Login to your Brigit account on the web at www.hellobrigit.com

Go to settings

Click ‘Your membership’

Click ‘Switch to this plan’ (Free plan)

Scroll down and tap the green text that says ‘Pause or switch plan’

Scroll down and tap the green text that says ‘Switch to the Free plan’

Select your reason for leaving and tap ‘Submit and switch to free’

Go back to settings

Select ‘Delete My Account’

Confirm you want to delete

You’re done!

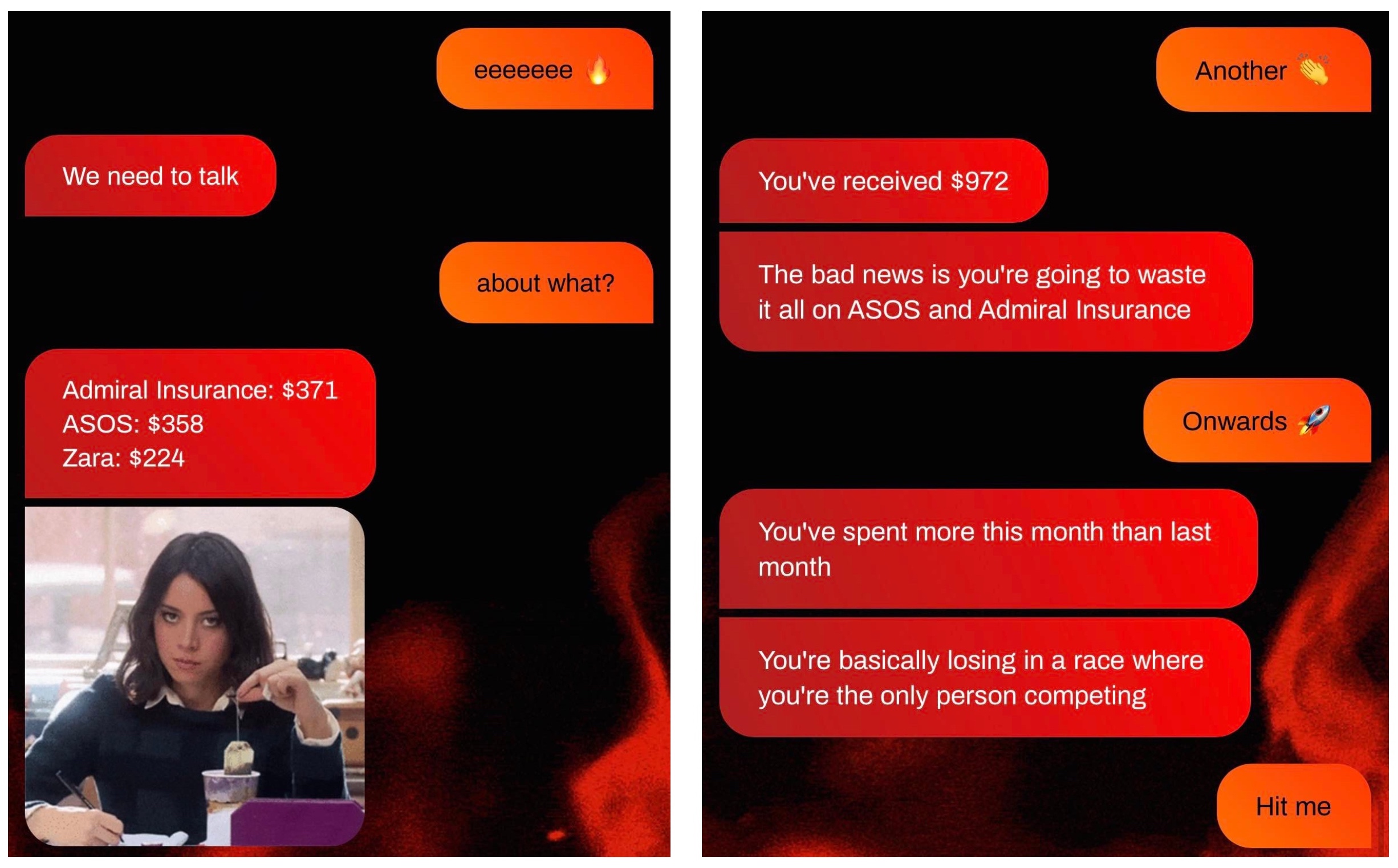

Cleo: the money app that roasts you

Need to be playfully held accountable for your, let’s say, questionable spending habits? Want a little extra personality from your money app? Meet Cleo, the money app that roasts you.

With Cleo, you can:

💙 Build a budget that’s right for you

💙 Use autosave1 to build savings without thinking

💙Get roasted for your questionable money habits, and hyped for all the good you’re doing

Enjoy this post? Give it a share or send it along to a friend. You never know, it could make a big difference.

Big love, Cleo 💙

1The Cleo Grow subscription service offers users savings goals, hacks, challenges, and access to an annual percentage yield (APY) on savings.