How Does MoneyLion Work? A Quick Overview

What is MoneyLion and is it the right cash advance app for you?

What is MoneyLion?

MoneyLion is a mobile banking platform that offers a variety of financial services and products including its ‘Instacash’ cash advance, credit monitoring, and investment management. But how does MoneyLion work to provide these services effectively?

It launched in 2013 and its headquarters are based in New York 🍎

Forbes Advisor says “Instacash allows you to borrow up to 30% of your recurring cash direct deposit per pay cycle with no credit check. For example, if you have a $700 biweekly deposit, your advance will be $210.”

How does MoneyLion work?

If you’re eligible for MoneyLion’s ‘Instacash’ feature, you can take out cash advances of up to $500. There are no credit checks or monthly fees. So, how does MoneyLion work to make this possible? It checks your finances, like your credit score and income, to see if you qualify.

The cash advance amount depends on your individual financial circumstances, including your credit score and income.

(PSA: We just thought we’d mention, unlike other cash advance apps, Cleo doesn’t require a specific income 🤎)

In the beginning, you’ll unlock $25 or more with Instacash. And if MoneyLion detects recurring deposits in your linked external account, you’ll unlock amounts up to $500.

On average, MoneyLion says it takes around three to eight weeks to become eligible for the maximum amount of Instacash.

Repayments are automated. You’ll only pay back the cash advance amount, however, if you’ve requested an instant cash advance, you’ll pay the turbo fee too.

Is MoneyLion legit?

MoneyLion uses industry-standard encryption to protect your data. They’re powered by Pathward, N.A., member of the FDIC.

And if you don’t know what the FDIC is, it’s the Federal Deposit Insurance Corporation. It’s a U.S. government corporation that supplies deposit insurance to depositors in American commercial banks and savings banks.

You’re welcome.

So is MoneyLion Legit? Yeah… they’re legit.

PSA: If you’re comparing cash advance apps, always do your own research first to double-check they’re safe and legit.

MoneyLion Cash Advance Reviews

MoneyLion has a Google Play rating of 4.5/5 from over 86,000 reviews.

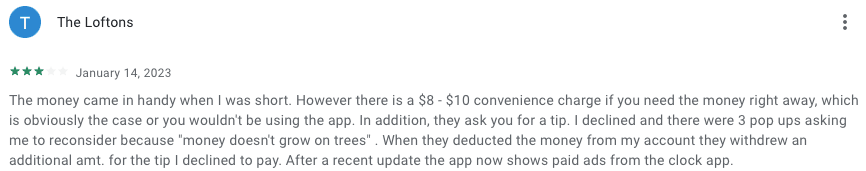

Google Play Review

Google Play Review

What are some Apps Like MoneyLion?

1) Chime

Chime offers a fee-free overdraft service called SpotMe.

If it’s your first time using SpotMe, you’ll usually start with a $20 limit but this might increase over time.

To be eligible, you’ll need to have at least $200 worth of qualifying direct debits into your Chime account each month. And you’ll also need to have an active Chime debit card.

💵 Maximum amount: $200

🏦 Fees: Option to tip and no late fees

✅ Repayment: Your next payday

🔎 Credit check: No

📈 Interest: No

Chime has a Trustpilot rating of 2.9/5 from over 8,000 reviews.

To see the full list of apps like MoneyLion, head over to The Best Cash Advance Apps in 2023 💵

2) Dave

Dave has a $1 per month membership fee which gives you access to account monitoring, notification services, and budgeting.

The cash advance should be with you within one to three business days but you can pay an express fee if you need it urgently (brunch dates don’t count).

If you opt for instant cash, you’ll need to pay an express fee of $0.99 to $6.99 for Dave Spending Account and $2.99 to $11.99 for external transfers.

💵 Maximum amount: $500

🏦 Fees: $1 monthly membership and no late fees

🚀 Speed: one to three business days

✅Repayment: your next payday

🔎 Credit check: no

📈 Interest: no

Cleo can help you escape the cash advance cycle. How? By creating a budget that works for you (not the other way round), so you can save each month.

And did we mention Cleo will call you out when you go over budget?

Welcome to 🔥 Roast Mode 🔥

Enjoy this post? Give it a share or send it along to a friend. You never know, it could make a big difference.

Big love. Cleo 🤎