Maximizing Your Credit Score: Building Credit Fast

Need ways to build your credit score fast? We got you ⚡

It's easy to fall into the trap of bad credit or no credit at all, especially when you're just starting out.

So you want to build your credit score fast? We’ve got you. Building credit is all about patience and persistence, but there are ways you can speed up the process.

It’s basically about understanding what makes up your credit score, and using this to your advantage. And there are tools you can use to help with that.

Let’s take a scroll.

The Credit Problem

Before we dive into the ways to build credit fast, let's talk a little about the struggle when it comes to credit. Establishing credit is a bit like a chicken-and-egg situation. To get credit, you often need to have credit. And for those of us who have never taken out a loan or owned a credit card, that can seem like an impossible hurdle.

It's also shockingly easy to slip into a negative pattern with credit. Late payments, maxed-out credit cards, and collections accounts can quickly drag your credit score down into the abyss. Plus, bad credit can haunt you for years, making it challenging to secure loans, rent apartments, or even get a job in some cases.

So, what's the solution? How can you build credit fast and escape this seemingly never-ending cycle of credit woes? We've got you covered with some practical ways to build credit fast.

1. Understand Your Credit Score Factors

Before delving into the fastest ways to build credit, it's important to understand the basics. Your credit score is a three digit number that shows people how reliable you are at repaying credit. It ranges from 300 to 850. The higher your score, the more trustworthy you appear to lenders.

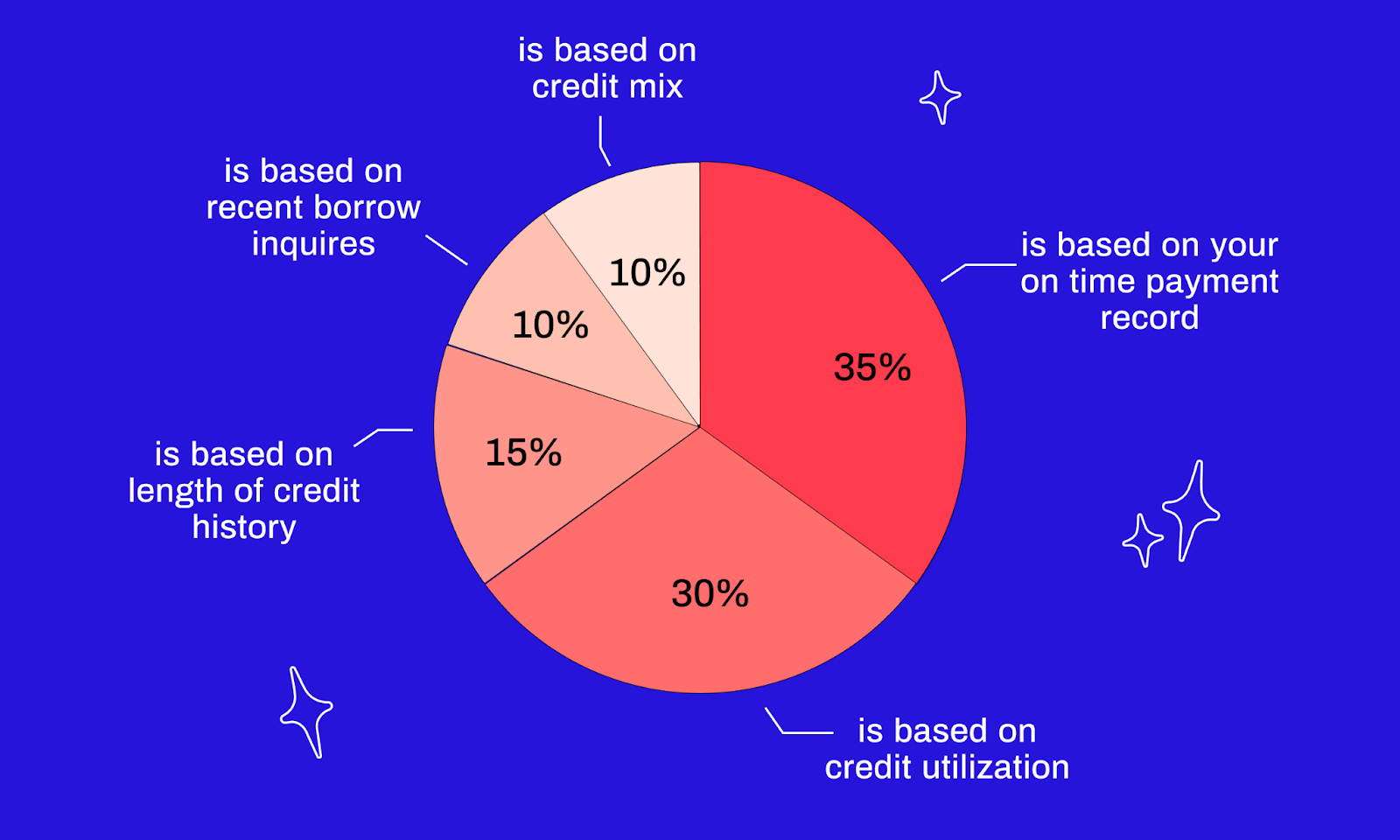

Understanding the factors that affect your credit score is key to building credit fast. The main factors include:

2. Consistent, On-Time Payments

One of the most crucial ways to build credit fast is by making consistent, on-time payments on your credit accounts. Whether it's a credit card, student loan, or even your rent, paying your bills on time really helps.

Late payments can have a huge negative impact on your credit score. So, set up reminders, automate payments, and do whatever it takes to ensure you never miss a due date. (Ahem, with Cleo you can get bill reminders for upcoming payments.)

3. Keep Credit Utilization Low

Your credit utilization ratio is the percentage of your credit limit that you're using at any given time. To build credit fast, aim to keep this ratio as low as possible, ideally below 30%.

High credit utilization basically signals that you’re needing all the credit you can get to creditors and result in a lower credit score. So, try not to max out your credit cards and consider spreading your expenses across multiple cards if needed.

4. Become an Authorized User

Another clever way to build credit fast is by becoming an authorized user on someone else's credit card account. If you have a responsible family member or friend who's willing to add you to their account, it can give your credit score a boost.

Obviously, think about how close you are with this person and how solid your relationship before you bring money into the equation.

Just remember that this strategy works best when the main account holder has a strong credit history and a record of on-time payments. Their positive credit behavior can reflect positively on your credit report.

5. Diversify Your Credit Mix

Credit scoring models like to see a diverse mix of credit accounts. This includes a combination of credit cards, installment loans (like student loans or personal loans), and retail accounts.

If you only have one type of credit account, consider diversifying by opening another type. Just be sure to manage these accounts responsibly, and don’t take on more than you can handle.

6. Regularly Check Your Credit Report

Building credit fast also involves monitoring your credit report for errors and inaccuracies. Mistakes can happen, and they might be dragging your score down without you even knowing it.

You're entitled to one free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – every year. Take advantage of this and review your reports for any mistakes. If you find errors, dispute them quickly to get them corrected.

7. Avoid Opening Too Many New Accounts

Ok, it’s essential to diversify your credit mix, but opening too many new accounts in a short period can have a negative impact on your credit score. Each credit application triggers a hard inquiry, which can lower your score slightly.

Have a plan. Be careful about the credit accounts you open and avoid a flurry of new applications within a short time.

8. Be Patient and Persistent

Sorry to sound like your high school coach right now, but building credit fast isn't a sprint; it's more like a marathon.

It takes time to see improvements in your credit score. But by consistently following these tips, you'll be well on your way to a healthier credit score and the quarter-life apartment of your dreams.