Cleo Credit Builder Cardholder Agreement 2025

Find the terms and benefits of the Cleo Credit Builder Card with our comprehensive cardholder agreement. Build your credit, access rewards, and take charge of your financial future.

Last Revised: March 2025

Please keep these Cleo Credit Builder Card Truth in Lending Disclosure, Security Deposit Electronic Funds Transfer Disclosure, and Cleo Credit Builder Card Agreement (“Agreement”) for your records. The Cleo Credit Builder Card (“Card”) is offered by WebBank, Member FDIC (“we”, “us” and our”).

You must provide information that is true, correct, and complete and keep this information up to date. In addition, you certify that you have the legal capacity to enter into this contract and furthermore that you agree to be held liable for payment of all amounts owing on the account.

Table of Contents

Important Disclosures

Cleo Credit Builder Card Truth in Lending Disclosure

Security Deposit Electronic Funds Transfer Disclosure

Cleo Credit Builder Card Agreement

1. Agreement to terms

2. Definitions that govern this agreement

3. Disclosures

3.1. Important Disclosures

3.2. USA PATRIOT Act Disclosure

3.3. Military Annual Percentage Rate Disclosure

3.4. Additional Disclosures

3.5. State disclosures

4. Security Deposit

4.1. Purpose

4.2. Funding your Security Deposit

4.3. Your Pledge, Grant and Assignment of Security Interest

4.4. Maintaining a Security Deposit balance

4.5. Withdrawals from your Security Deposit

4.6. Applying Security Deposit funds to your Card Account

4.7. Your Security Deposit and Electronic Funds Transfers

5. Credit Limit

5.1. How your credit limit is determined

5.2. Understanding your credit limit

5.3. Respecting your Credit Limit

6. Using your card

6.1. Where and how you can use your card

6.2. Authorizations

6.3. Limitations on use of your card

7. Card Payments

7.1. Promise to pay

7.2. How we calculate your balance due

7.3. When your payment is due

7.4. Carefree Credit Building

7.5. Manual payments

7.6. Payment timing

8. Our Rights on Default

8.1. Reasons for default

8.2. Our Rights Upon Your Default

8.3. Cleo Builder Subscription

9. Fees

10. Reporting to credit reporting agencies

10.1. What and when we report

10.2. When We Issue Negative Reports

10.3. Disputing Information Reported to Credit Reporting Agencies

11. Card Account closure

11.1. Voluntary card account closure

11.2. Account Closure Does Not Affect Promise to Pay

12. Cards

12.1. Card information

12.2. Flagging your card is lost or stolen

13. Liability for certain unauthorised card transactions

14. Error adjustments

15. Billing rights

15.1. Billing Rights Overview

15.2. Billing Errors

16. No Waiver of Rights

17. Our communication with you

18. Assignments and Transfers

19. Foreign Transactions

20. Disclosure of Information to Third Parties

21. Governing Law

22. Arbitration Provision

22.1. Definitions

22.2. Right to Elect Arbitration

22.3. No Jury Trial or Class Claims

22.4. Initiation of Arbitration

22.5. Public Injunctive Relief

22.6. Arbitration Award and Appeals

22.7. Enforcement of this Arbitration Provision

22.8. Opt-Out Right

23. Force Majeure

24. LIMITATION OF LIABILITY

25. Change in Terms

26. Severability

27. Entire Agreement

Important Disclosures

Cleo Credit Builder Card Truth in Lending Disclosure

*The ATM provider may also charge their own fee.

Billing Rights: Information on your rights to dispute transactions and how to exercise those rights is provided in your Cleo Credit Builder Card Agreement.

Security Deposit Electronic Funds Transfer Disclosure

(a) Depositing funds to your Security Deposit and withdrawing funds from your Security Deposit could be conducted as an Electronic Fund Transfer (“Transfer”). This Section includes Electronic Fund Transfer Disclosures that supplement other disclosures in this Agreement.

a. Contact in event of unauthorized transfer if you believe there has been an unauthorized transfer on your Security Deposit, email us at cleobuilder@meetcleo.com write us at WebBank c/o Cleo AI Inc, 150 West 25th Street, RM 403, New York City, NY 10001 or call us at call: +1 833 313 3171

b. Business days. For purposes of these disclosures, our business days are every day except Saturdays, Sundays and federal holidays.

(b) Transfer Types and Limitations.

Account Access - The kinds of Transfers that may be made from your Security Deposit include those Transfers that occur when adding funds to your Security Deposit and making manual payments towards your Cleo Credit Builder Card balance. See section 4 of your Cleo Credit Builder Card Agreement for information on funding your Security Deposit and Section 7 of your Cleo Credit Builder Card Agreement for information about payments using your security deposit.

1. Limitations on frequency of transfers: There are no limits on the number of times you can add or withdraw funds to your Security Deposit, however we will limit the making of manual payments towards your Cleo Credit Builder Card balance to twice a month.

2. Limitations on dollar amounts of transfers: The dollar amount of transfers from your Security Deposit is limited to the amount in your Security Deposit. The total dollar amount you can add to your Security Deposit cannot exceed a total balance of $25,000. And the dollar amount of any transfer may be limited to by this maximum amount.

(c) Confidentiality We will disclose information to third parties about your Security Deposit or the transfers you make:

(i) Where it is necessary for completing transfers, or

(ii) In order to verify the existence and condition of your Security Deposit for a third party, or

(iii) In order to comply with government agency or court orders, or

(iv) If you give us your written permission.

(d) Documentation

(1) Preauthorized credits. If you have arranged to have direct deposits made to your Security Deposit at least once every 60 days from the same person or company, we will let you know if the deposit is made. You can contact us at cleobuilder@meetcleo.com to find out whether the deposit has been made.

(2) Periodic statements. You will get a monthly Security Deposit statement unless there are no transfers in a particular month. In any case you will get the statement at least quarterly.

(e) Financial institution's liability If we do not complete a transfer to or from your Security Deposit on time or in the correct amount according to our agreement with you, we will be liable for your losses or damages. However, there are some exceptions. We will not be liable, for instance:

(1) If, through no fault of ours, you do not have enough money in your account to make the transfer.

(2) If circumstances beyond our control (such as fire or flood) prevent the transfer, despite reasonable precautions that we have taken.

(3) There may be other exceptions stated in our agreement with you.

(f) Error Resolution Notice

Initial and annual error resolution notice

In Case of Errors or Questions About Your Electronic Transfers email us at

cleobuilder@meetcleo.com or write us at WebBank c/o Cleo AI Inc, 150 West 25th Street, RM 403, New York City, NY 10001, or call us at +1 833 313 3171 (option as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer listed on the statement or receipt. We must hear from you no later than 60 days after we sent the FIRST statement on which the problem or error appeared.

(1) Tell us your name and the email address linked to your Cleo Builder Account

(2) Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information.

(3) Tell us the dollar amount of the suspected error.

If you tell us orally, we may require that you send us your complaint or question in writing within 10 business days.

We will determine whether an error occurred within 10 business days after we hear from you and will correct any error promptly. If we need more time, however, we may take up to 45 days to investigate your complaint or question. If we decide to do this, we will credit your Security Deposit within 10 business days for the amount you think is in error, so that you will have the use of the money during the time it takes us to complete our investigation. If we ask you to put your complaint or question in writing and we do not receive it within 10 business days, we may not credit your Security Deposit.

For errors involving newly established Security Deposits, point-of-sale, or foreign-initiated transactions, we may take up to 90 days to investigate your complaint or question. For newly established Security Deposits, we may take up to 20 business days to credit your Security Deposit for the amount you think is in error.

We will tell you about the results within three business days after completing our investigation. If we decide that there was no error, we will send you a written explanation. You may ask for copies of the documents that we used in our investigation.

Cleo Credit Builder Card Agreement

Section 1. Agreement to Terms

By applying for a Card Account, signing the Card or otherwise using or consenting to the use of the Card Account, you agree to the terms and conditions of this Cardholder Agreement and that this Agreement will govern your Card Account, the use of your Card, and all credit extended under this Agreement. You also agree that your use of your Card Account, whether by use of your Card or otherwise, will constitute your acceptance of, and will be subject to, this Agreement.

Section 2: Definitions

The definitions that govern this agreement:

“Available Credit Limit” means the amount of credit you have available to spend on your Card Account at any given time.

“Billing Cycle” means the interval between billing statements. Each billing statement shows a closing date. The statement closing date is the last day of the Billing Cycle for that billing statement.

“Business Day” means every day except Saturdays, Sundays and any bank or federal holidays.

“Cleo Builder Subscription” means the subscription tier available through the Cleo mobile application that permits consumers to apply for the Card Account.

“Card” means any physical or virtual charge card issued to you that is associated with your Card Account. We also refer to the Card as the Cleo Credit Builder Card.

“Card Account” means your consumer credit account with WebBank that is subject to this Agreement.

“Carefree Credit Building” means a payment option where automatically each month the funds you have in your Security Deposit are applied to the New Balance.

“Credit Limit” is the total amount of credit that we will extend to you in connection with your Card Account.

“Default” means that you are in breach of this Agreement, including if we did not receive your full payment by your Payment Due Date.

“New Balance” means the total outstanding balance of your Card Account at the end of any Billing Cycle, as shown on your billing statement.

“Payment Due Date” means the date that your New Balance is due.

“Purchase” means your purchase of goods or services with the use of a Card Account.

"Security Deposit" means the funds that you pledge to us as security for your Card Account.

Section 3: Disclosures

3.1 Important Disclosures

Your Cleo Credit Builder Card Truth in Lending Disclosure and Security Deposit Electronic Funds Transfer Disclosure are incorporated as part of this agreement.

3.2 USA PATRIOT Act Disclosure: Important Information About Procedures for Opening a New Account

To help the government fight the funding of terrorism and money laundering activities, Federal law requires financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: when you open an account, we will ask for your name, address, date of birth, SSN / ITIN and other information that will allow us to identify you. We may also ask for your driver's license, passport or other identifying information.

3.3 Military Annual Percentage Rate Disclosure

Federal law provides important protections to active duty members of the Armed Forces and

their dependents relating to extensions of consumer credit. In general, the cost of consumer credit to a member of the Armed Forces and his or her dependent may not exceed an annual percentage rate of 36 percent. This rate must include, as applicable to the credit transaction or account: The costs associated with credit insurance premiums; fees for ancillary products sold in connection with the credit transaction; any application fee charged (other than certain application fees for specified credit transactions or accounts); and any participation fee charged (other than certain participation fees for a credit card account).

To receive this disclosure and a clear description of your payment obligation verbally, please call: 1-833-313-3171

If you are a member of the armed forces or a dependent of such member who is covered by the federal Military Lending Act, then (a) Section 22 (Arbitration) and Section 24 (Limitation of Liability) shall not apply to you; and (b) any provision in this Agreement that is not permitted or enforceable against you under the Military Lending Act, shall not apply to you.

3.4 Additional Disclosures

There are additional disclosures concerning your Card Account in other sections of this Agreement, including the Reporting to Credit Reporting Agencies and Billing Rights sections.

3.5 State Disclosures

New Jersey Residents: Because certain provisions of this Agreement are subject to applicable law, they may be void, unenforceable or inapplicable in some jurisdictions. None of these provisions, however, is void, unenforceable or inapplicable in New Jersey.

Ohio Residents: The Ohio laws against discrimination require that all creditors make credit equally available to all creditworthy customers, and that credit reporting agencies maintain separate credit histories on each individual upon request. The Ohio Civil Rights Commission administers compliance with this law.

Married Wisconsin Residents: If you are married, by submitting your Card application you are confirming that this Card obligation is being incurred in the interest of your marriage and your family. No provision of a marital property agreement, unilateral statement under Section 766.59 of the Wisconsin Statutes, or court order under Section 766.70 of the Wisconsin Statutes adversely affects the interest of the creditor unless the creditor, prior to the time the credit is granted, is furnished a copy of the agreement, statement or decree or has actual knowledge of the adverse provision when the obligation to the creditor is incurred. If the Card for which you are applying is granted, you will notify us if you have a spouse who needs to receive notification that credit has been extended to you.

Section 4: Security Deposit

4.1 Purpose of Security Deposit

Your Card Account is secured by the Security Deposit that you are required to establish and maintain in order to have the Card Account. A Security Deposit is required for us to issue you a Card. We may in our sole discretion determine the minimum Security Deposit that is required for us to issue you a Card. The Credit Limit we extend to you will equal the amount of your Security Deposit. No interest will be paid on the Security Deposit. If you fail to make your required payments on your Card Account or otherwise fail to comply with the terms of the Cardholder Agreement, you could lose all Funds in your Security Deposit. You understand and agree that you have established and will maintain the Security Deposit as security for the Card Account.

4.2 Funding your Security Deposit

You may add funds to your Security Deposit at any time, subject to the restrictions stated herein, and only for the purpose of securing your Card Account. Funding the Security Deposit for any other purpose is not permitted. You may only add funds to the Security Deposit through the methods we make available. Your ability to add funds to your Security Deposit may also be subject to limitations from the financial institution that holds the account you intend to use as a source for funding the Security Deposit.

If you cancel your Cleo Builder Subscription, you may not add funds to your Security Deposit during your pending state of cancellation.

4.3 Your Pledge, Grant and Assignment of Security Interest

You acknowledge that granting us a security interest in the funds you provide for the Security Deposit and the Security Deposit is a necessary condition to open your Account. You grant us a security interest in the funds you provide for the Security Deposit, including all proceeds of and additions to such funds and any portion of the funds in excess of the Credit Limit. You grant us this security interest to secure payment of any and all of your obligations to us arising under or relating to the Card Account, including any expenses that we incur in enforcing your obligations under this Agreement, where permitted by applicable law (“Debt”). You agree to take any actions needed for us to perfect or protect the first lien position of our security interest in the funds you provide for the Security Deposit. You represent that there are no current lawsuits or bankruptcy proceedings that might affect our interest in the funds you provide for the Security Deposit. You have not and will not transfer or offer or attempt to transfer or offer any interest in the funds you provide for the Security Deposit to any person other than us.

4.4 Maintaining a Security Deposit Balance

You understand and agree that maintaining a balance greater than $1 in your Security Deposit, or any other amount that we determine is necessary in our sole discretion, is required to maintain your Card Account. You must maintain funds in the Security Deposit sufficient to cover all amounts you owe in connection with the Card Account and your desired Credit Limit.

You cannot use any portion of the Security Deposit to secure any other extension of credit and must keep the Security Deposit free of any liens, security interests, or other encumbrances other

than the security interest that you grant to us.

4.5 Withdrawals from your Security Deposit

You cannot make withdrawals from the Security Deposit while those funds are being used to secure your Debt to us except as we otherwise permit. If we permit you to withdraw funds from the Security Deposit, we will return the funds to you within 45 days.

4.6 Applying Security Deposit funds to your Card Account

You may request that we apply the funds in your Security Deposit to the outstanding balance for your Card Account, either through Carefree Credit Building or as a manual payment as discussed below, and we will apply such funds to your outstanding balance. However, any removal of funds from your Security Deposit, will lower your Credit Limit.

If you are in Default under this Agreement or your Card Account is closed for any reason, we will apply your Security Deposit towards any outstanding Debt and we may do so without any additional notice to you or any demand for payment from you. You will continue to be responsible for repaying any outstanding Debt. If you are delinquent and add funds to your Security Deposit in an amount that is greater than your outstanding Debt, we will immediately apply such funds to your outstanding Debt and the remaining amount will be added to your Security Deposit. Our rights under this Agreement are in addition to any others we have under applicable law.

4.7 Your Security Deposit and Electronic Funds Transfers

For information about your electronic funds transfers in connection with your Security Deposit, including your rights in the event of an error, see your Security Deposit Electronic Funds Transfer Disclosure.

Section 5: Credit Limit

5.1 How your Credit Limit is Determined

Your Credit Limit is limited by the balance of your Security Deposit. Except as otherwise provided herein, when you add funds to your Security Deposit, we will increase your Credit Limit to the balance of your Security Deposit.

We may increase or decrease your total Credit Limit at our discretion.

Purchases, including any authorization hold, will decrease your Available Credit Limit immediately when the Card is used at the merchant.

If you use your Card at a merchant where the pre-authorization amount may differ from the final amount processed, for example gas stations and restaurants, we will attempt to prevent you from exceeding your Credit Limit, which may result in a decline of your authorization.

Card cash advances via an ATM will decrease your Available Credit Limit immediately when the Card is used at the ATM. When accessing cash at an ATM a limit of 90% of your Available

Credit Limit is applied.

5.2 Understanding your Credit Limit

Your statement for your Card will show your Credit Limit and the amount of your Available Credit Limit as of the closing date of your billing cycle. Your current Credit Limit and Available Credit Limit can be found at any time using the Cleo app.

5.3 Respecting your Credit Limit

You promise not to engage in any transactions that will cause you to exceed your Credit Limit. This means that your balance, including any transactions we have authorized but that have not yet been processed, may not exceed your Credit Limit at any time.

If you attempt a transaction that would cause you to exceed your Credit Limit, we may in our discretion authorize the transaction without increasing your Credit Limit or we may deny the authorization. If we do allow you to exceed your Credit Limit at any time, that does not obligate us to do so any other time. Without limiting our other rights under this Agreement, including our rights under the “Our Rights Upon Default” section, you agree that if you exceed your Credit Limit at any time you will immediately pay us for the full amount of the excess over the Credit Limit, as applicable.

Section 6: Using your Card

6.1 Where and how you can use your Card

Subject to your Credit Limit, you may use your Card to make Purchases so long as you are not in Default of this agreement. We, however, are not required to authorize or permit any Purchase and may limit or suspend your ability to make a Purchase at any time in our sole discretion.

Subject to a limit of 90% of your Available Credit Limit, you may use your Card to access a cash advance at an ATM so long as you are not in Default of this agreement. We, however, are not required to authorize or permit any attempt to access cash at an ATM and may limit or suspend your ability to access cash at an ATM at any time at our sole discretion.

6.2 Authorizations

Transactions at some merchants (such as hotels, car rental companies, restaurants, and gas stations) may result in temporary authorizations for amounts greater than the actual Purchase amount. If this happens, it will make less credit available to you on your Card Account for several days (usually until the date the actual Purchase amount is received by us from the merchant).

6.3 Limitations on use of your Card

You agree to use your Card only for personal, family, or household purposes. You also confirm that your Card will not be used for purposes that are illegal under federal or state law, including without limit illegal gambling activity. We reserve the right to deny transactions or authorizations from merchants that appear to be engaged in illegal activities. We are not responsible if anyone does not allow you to use your Card or refuses to accept your Card. We may decline any transaction at any time for any reason in our discretion.

If you give your Card to any other person to use or otherwise authorize any person to use your Card, you will be responsible for that person’s use of your Card and anyone else they allow to use your Card, even if you did not anticipate, or agree to, that use. You are responsible for such transactions with your Card.

Section 7: Card Payments

7.1 Promise to Pay

You promise to pay us all amounts you owe on your Card Account, including without limitation, the total amount of all Purchases, all card cash advances, all fees, and all other charges described in this Cardholder Agreement. You must make a payment every month that your Card Account reflects a New Balance (the “New Balance” is the entire amount that you owe us at that time). If you do not pay your New Balance in full by the payment due date as reflected on your billing statement, it will be considered late and you will be in Default. See “Our Rights Upon Default” in Section 8, below, for consequences of Default.

7.2 How we Calculate your New Balance Due

This is a secured charge card, which means it must be paid in full every month. To calculate your balance each month, the New Balance, we begin with the outstanding balance from the previous month, and add purchases, card cash advances, fees, and transactions posted to your account associated with the Card. We subtract any payments and credits that we receive. If there is still an outstanding balance after the Payment Due Date, you agree that we may consider your Card Account to be in Default, and funds from your Security Deposit may be applied to satisfy the outstanding balance.

7.3 When your Payment is Due

Payments must be made using the Cleo mobile application and must be made in full each month by the applicable due date. Each month, you will be provided a periodic statement showing your New Balance, Payment Due, and the Payment Due Date.

You may choose to make payments automatically using the funds in your Security Deposit, which is called “Carefree Credit Building,” or to pay manually, either from an additional payment method you have provided within the Cleo application or the funds in your Security Deposit.

7.4. Carefree Credit Building

Carefree Credit Building is one of your payment options where each month, by your Payment Due Date, we apply the funds in your Security Deposit to the New Balance on your Card. If you enable Carefree Credit Building, funds from your Security Deposit will be applied to your New Balance in full automatically on or before your payment due date. You will be notified of the amount that will be automatically applied in the same communication notifying you that your statement is available. When the amount from your Security Deposit is applied, your Available Credit Limit will be reduced until you replenish your Security Deposit balance.

We will notify you before and after the Security Deposit is applied to your New Balance.

If you want to opt out of or into Carefree Credit Building, you may do so at any time by simply visiting the “Spend Tab” within the Cleo mobile application, and use the “Manage,” feature.

7.5 Manual Payments

You may also pay your New Balance each month manually. You may make a manual payment by requesting that we apply the funds in your Security Deposit to the New Balance, or by using any other payment method we make available to you. If you choose to manually repay, you must ensure we receive your payment in a timely manner.

7.6 Payment Timing

To ensure a timely payment, we must receive your payment by 5 p.m. Eastern Time on a Business Day in order to be credited to your Card Account on that day. More details on how to ensure we receive your payment in a timely manner are provided with your periodic statement.

Section 8: Our Rights on Default

8.1 Reasons for Default

You will be in “Default” under this Agreement if:

You fail to pay any balance due by its due date.

You exceed your Credit Limit.

You fail to meet the conditions of, or to perform any obligation under this Agreement or any other agreement relating to the Card or your Cleo Builder Subscription. ● You have given misleading information or made misrepresentations in connection with your Card Account.

Any government authority takes action against you that we believe adversely affects your financial condition or ability to repay your Card; or

You file a bankruptcy petition, a bankruptcy petition is filed against you, or you make a general assignment for the benefit of creditors.

8.2 Our Rights Upon Your Default

If you are in Default, we may:

Apply your Security Deposit to pay any and all amounts owed in connection with your Card Account.

Exercise any other right that we may have under our security interest in the Security Deposit.

Accelerate any amount that you owe such that it is immediately due.

Suspend your Card Account and/or not authorize new transactions.

Close your Card Account and/or cancel your Card; and/or

Exercise any other right that we have under this Agreement or applicable law to enforce our rights.

8.3: Cleo Builder Subscription

To maintain access to the Card Account, your Cleo Builder Subscription must remain in good standing. If you fail to make any required subscription payments or otherwise are in default in connection with your Cleo Builder Subscription, then you also are in breach of this Agreement.

If you have chosen to cancel your Cleo Builder Subscription, you will be able to spend up to your approved Credit Limit until the end of your current subscription period. At the end of that subscription period, your Card Account will be closed.

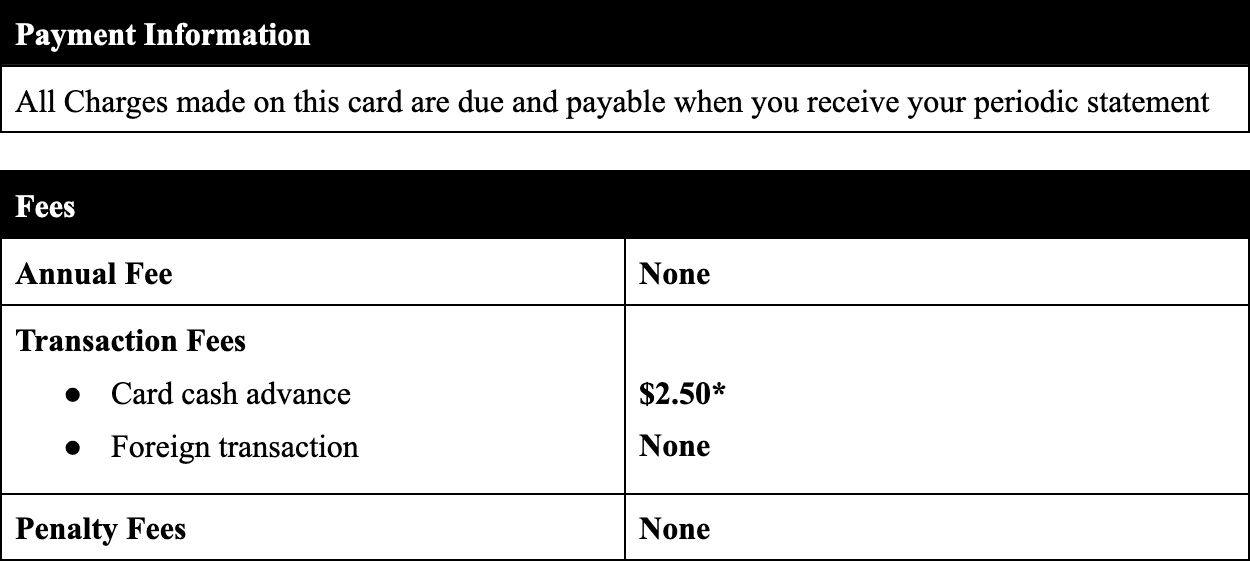

Section 9: Fees

a. Annual Fee. There is no annual fee on your Card Account.

b. Late Payment Fee. If payment of your New Balance in full is not received by your payment due date, you will not be charged a late payment fee, however, it will be considered late and you will be in Default. See “Our Rights Upon Default” for consequences of Default.

c. Foreign Transaction Fees. There is no fee for foreign transactions. However, you will be subject to VISA exchange rates. See “Foreign Transactions” below for more information.

d. ATM Card Cash Advance: $2.50. In addition, your ATM provider may charge their own fee.

e. Fees for Other Services. We may charge you other fees for services associated with your Card Account that you request in accordance with applicable law.

Section 10: Reporting to Credit Reporting Agencies

10.1 What and When We Report

Each month, we may report your credit history, including your positive repayment and length of tenure, to any of the three credit reporting agencies. Although timely payment of your Credit Builder Card is one aspect required for credit score improvement and therefore use of the Credit

Builder Card may boost your credit score, impact to scores may vary and some cardholders’ scores may not improve. Therefore, we make no guarantee regarding the improvement of your credit score.

10.2 When We Issue Negative Reports

YOU ARE HEREBY NOTIFIED THAT A NEGATIVE CREDIT REPORT REFLECTING YOUR CREDIT HISTORY WITH US MAY BE SUBMITTED TO A CREDIT-REPORTING AGENCY IF YOU FAIL TO FULFILL THE TERMS OF YOUR CREDIT OBLIGATIONS. LATE PAYMENTS, MISSED PAYMENTS, OR OTHER DEFAULTS ON YOUR CARD ACCOUNT MAY BE REFLECTED IN YOUR CREDIT REPORT.

10.3 Disputing Information Reported to Credit Reporting Agencies

If you believe that we have furnished any inaccurate information relating to your Card Account to any consumer reporting agency, you may notify us at the following address: WebBank c/o Cleo AI Inc, 150 West 25th Street, RM 403, New York City, NY 10001. You may also email us at cleobuilder@meetcleo.com. To help us respond to your notification, you must provide us sufficient information to identify the account at issue (such as your Card Account number), the information you are disputing, and the nature of the dispute. You may also include supporting documentation. Depending on the nature of the dispute, we may request supporting documentation from you. You also have the right to dispute information reported about you with the applicable consumer reporting agency.

Section 11: Card Account Closure

11.1 Voluntary Card Account Closure

If you wish to close your Card Account, you are able to do so either from within the Cleo mobile application or by contacting our dedicated support team at cleobuilder@meetcleo.com. We will cancel your Card Account once we receive notice and confirmation from you and have a reasonable opportunity to process the notice.

You agree that we are not responsible for any costs, damages, or inconvenience you may suffer as a result of our cancelling your Card Account.

11.2 Account Closure Does Not Affect Promise to Pay

Cancellation of the Card and the Card Account, whether by your or by us, does not relieve you from your obligation to pay all amounts that you owe. You will remain responsible and must pay for all credit owed to us (extended to you or arising from use of your Card Account prior to or subsequent to cancellation) or any other Debt you owe us.

Section 12: Cards

12.1 Card Information

Any Cards that we issue to you belong to us. We, a merchant, or any party acting on our behalf, may retain your Card without prior notice to you. You agree to sign your Card in the space provided for authorized signatures before you use the Card. Your Card is issued with an expiration date. We have the right to not renew your Card or Card Account. If we have not terminated your Card Account or exercised our right not to renew your Card Account, we will send you a new Card when your prior Card expires.

12.2 Flagging your Card is Lost or Stolen

If you realize that your Card has either been lost or stolen, you agree to contact us immediately - either through the Cleo mobile application or by emailing

cleobuilder@meetcleo.com. You are able to add a temporary block to your card within the Cleo mobile application to prevent further purchases on your card whilst you confirm the status of your Card.

Section 13: Liability for Certain Unauthorised Card Transactions

Contact us IMMEDIATELY if you believe your Card has been lost or stolen, your credentials have been compromised, or your Card Account has been accessed without your permission. You will not be liable for any such unauthorized transactions made on your Card Account that occurs after you notify us. You may, however, be liable for unauthorized use that occurs before your notice to us. In any case, your liability will not exceed $50. You may not use the Card or any other Cards in your possession with the same account number after you have notified us, even if you get the Card back.

Section 14. Error Adjustments

If funds are transferred or credited to your Card Account or Security Deposit by mistake or other error, we may correct the situation by deducting the amount of the erroneous transfer or credit from your Card Account or Security Deposit without prior notice to you.

Section 15: Billing Rights

15.1 Billing Rights Overview

Each month while your Card Account is open, we will provide you a billing statement showing your New Balance and the Payment Due Date. If you have consented to receive electronic disclosures, we will provide the billing statement to you electronically by notifying you by email that your billing statement is available. When you receive this email, you will need to login to your Card Account in the Cleo Application to view and print your billing statement. We may discontinue sending billing statements to you if we deem your Card Account to be uncollectible or if we sent your Card Account to an attorney or other third party for collection purposes.

15.2 Billing Errors

YOUR BILLING RIGHTS: KEEP THIS DOCUMENT FOR FUTURE USE This notice tells you about your rights and our responsibilities under the Fair Credit Billing Act.

What To Do If You Find A Mistake On Your Billing Statement:

If you think there is an error on your billing statement, write to us at:

a. WebBank c/o Cleo AI Inc, 150 West 25th Street, RM 403, New York City, NY 10001 Or

Cleobuilder@meetcleo.com

In your communication, give us the following information:

Account information: Your name and Card Account number.

Dollar amount: The dollar amount of the suspected error.

Description of problem: If you think there is an error on your bill, describe what you believe is wrong and why you believe it is a mistake.

You must contact us:

Within 60 days after the error appeared on your billing statement.

At least 3 business days before an automated payment is scheduled, if you want to stop payment on the amount you think is wrong.

You must notify us of any potential errors in writing. You may call us, but if you do, we are not required to investigate any potential errors and you may have to pay the amount in question.

What Will Happen After We Receive Your Communication:

When we receive your communication, we must do two things:

1. Within 30 days of receiving your communication, we must tell you that we received your communication. We will also tell you if we have already corrected the error.

2. Within 90 days of receiving your communication, we must either correct the error or explain to you why we believe the bill is correct.

While we investigate whether or not there has been an error:

We cannot try to collect the amount in question, or report you as delinquent on that amount.

The charge in question may remain on your billing statement.

While you do not have to pay the amount in question, you are responsible for the remainder of your balance.

We can apply any unpaid amount against your credit limit.

After we finish our investigation, one of two things will happen:

If we made a mistake: You will not have to pay the amount in question or any other fees related to that amount.

If we do not believe there was a mistake: You will have to pay the amount in question. We will send you a statement of the amount you owe and the date payment is due. We may then report you as delinquent if you do not pay the amount we think you owe.

If you receive our explanation but still believe your bill is wrong, you must write to us within 10 days telling us that you still refuse to pay. If you do so, we cannot report you as delinquent without also reporting that you are questioning your bill. We must tell you the name of anyone to whom we reported you as delinquent, and we must let those organizations know when the matter has been settled between us.

If we do not follow all of the rules above, you do not have to pay the first $50 of the amount you question even if your bill is correct.

Your Rights If You Are Dissatisfied With Your Card Purchases:

If you are dissatisfied with the goods or services that you have purchased with your Card, and you have tried in good faith to correct the problem with the merchant, you may have the right not to pay the remaining amount due on the Purchase.

To use this right, all of the following must be true:

1. The Purchase must have been made in your home state or within 100 miles of your current mailing address, and the Purchase price must have been more than $50. (Note: Neither of these are necessary if your Purchase was based on an advertisement we mailed to you, or if we own the company that sold you the goods or services.)

2. You must have used your Card for the Purchase. Purchases made with card cash advances from an ATM do not qualify.

3. You must not yet have fully paid for the Purchase.

If all of the criteria above are met and you are still dissatisfied with the Purchase, contact us in writing at:

a. WebBank c/o Cleo AI Inc, 150 West 25th Street, RM 403, New York City, NY 10001 Or

Cleobuilder@meetcleo.com

While we investigate, the same rules apply to the disputed amount as discussed above. After we finish our investigation, we will tell you our decision. At that point, if we think you owe an amount and you do not pay, we may report you as delinquent.

Section 16: No Waiver of Rights

We may delay in enforcing our rights under this Agreement without losing those rights or any other rights. We may waive enforcement of our rights in one or more instances without waiving those rights or any other rights in other instances.

Section 17: Our Communications with You

You expressly authorize us (which includes, for purposes of this paragraph, our affiliates, agents, and contractors) to monitor or record any calls between you and us. You also authorize us to contact you to service your Card Account or to collect amounts you owe at any number (a) you have provided to us (b) from which you called us, or (c) which we obtained and believe we can reach you at (including wireless, landline and Voice Over Internet Protocol numbers). You agree that we may contact you in any way, such as calling, texting, and may contact you using an automated dialer or using artificial or pre-recorded messages. You understand that anyone with access to your telephone may listen to or read the messages we leave or send you, and you agree that we will have no liability for anyone accessing such messages. You further agree that we may contact you on a mobile, wireless, or similar device, even if you are charged for it by your provider of telecommunications, wireless and/or data services, and you agree that we will have no liability for such charges. You also agree that we may contact you to service your Card Account or to collect amounts you owe at any email address you have provided to us or that we otherwise believe is associated with you. You agree that you are the owner and/or primary user of any telephone number or email address you provide to us and that you will promptly notify us if this is no longer true as to any such telephone number or email address.

Section 18: Assignments and Transfers

You may not transfer or assign any rights or obligations you have under this Agreement without our prior written consent. Your obligations under this Cardholder Agreement shall be binding upon your estate or personal representatives. We may assign this loan and any of our rights and obligations under this Agreement, in whole or in part, without your permission and without any notice to you.

Section 19: Foreign Transactions

You may choose to use your Card to make a Purchase in a foreign country (a “Foreign Transaction”). If your Foreign Transaction is in a currency other than U.S. dollars, the transaction will be converted into a U.S. dollar amount by Visa International Inc., using the procedures established by Visa International, Inc., based on the exchange rate in effect at the time the transaction is processed. The exchange rate between the transaction currency and the billing currency used for processing Foreign Transactions is a rate selected by Visa from the range of rates available in wholesale currency markets for the applicable central processing date, which may vary from the rate Visa itself receives, or a government-mandated rate in effect for the applicable central processing date, in each instance. There is no Foreign Transaction Fee as disclosed in the table at the top of this Agreement. We monitor your Card Account for signs of potential fraud, which could include the use of your Card in a manner that is out of the ordinary.

If you are planning on using your Card in a foreign country (for example, if you are travelling abroad) please let us know in advance. Otherwise it is possible that your Foreign Transactions may be delayed or declined. There are some countries in which we are required by law to block transactions and some countries for which we will not authorize the use of your Card Account due to fraud, terrorism or other concerns. Those countries change from time to time, so contact us in advance if you are planning on using your Card in a foreign country and want to confirm that the Card can be accepted in that country.

Section 20: Disclosure of Information to Third Parties

By requesting, obtaining or using a Card from us you agree that we may release information in our records regarding you and your Card Account: (a) to comply with government agency or court orders; (b) to share your credit performance with credit reporting agencies (c) to share information with our employees, agents or representatives performing work for us in connection with your Card Account; (d) as otherwise permitted by our privacy policy, or (e) as otherwise permitted by applicable law.

Section 21: Governing Law

This Agreement is entered into between you and us in the State of Utah and we extend credit to you from Utah. This Agreement will be governed by and construed in accordance with federal law, including the Federal Arbitration Act, and to the extent that state law applies, in accordance with the laws of the State of Utah without giving effect to any principles that provide for the application of the law of another jurisdiction.

Section 22: Arbitration Provision

The following arbitration provision (the “Arbitration Provision”) does not apply to you if you are a covered borrower under the Military Lending Act. Please read this Arbitration Provision carefully because you are waiving the right to have disputes heard by a judge and jury and you waive the right to bring or participate in a class, representative or private attorney general action. You may choose to have this Arbitration Provision not apply to this Agreement and your Card Account by following the instructions below under “Opt-Out Right.” This paragraph describes how all Claims (as defined below) will be arbitrated, at the election of you or us, on an individual (non-class, non-representative) basis instead of litigated in court.

22.1 Definitions

The term “Claim” means any claim, dispute, or controversy between you and us arising from or relating to your Card, your Card Account, or this Agreement, as well as any related or prior agreement that you may have had with us or the relationships resulting from this Agreement. It includes claims related to the validity, enforceability, coverage, or scope of this Arbitration Provision to the maximum extent permitted by the FAA. Claims arising in the past, present, or future, including Claims arising before the execution of this Agreement, are subject to arbitration. Claim also includes, without limitation, claims that arise from or relate to any application for the Card Account or any advertisements, promotions, or statements related to your Card Account. For purposes of this arbitration provision, “you” and “us” also includes any

corporate affiliates, any licensees, predecessors, successors, assigns, any purchaser of any accounts, Cleo, all agents, employees, directors and representatives of any of the foregoing, and other persons referred to below in the definition of Claims. Claim also includes claims of every kind and nature, including but not limited to initial claims, counterclaims, cross-claims, third-party claims, and claims based upon contract, tort, fraud, and other intentional torts, statutes, regulations, common law, and equity. Claims and remedies sought as part of a class action, private attorney general action, or other representative action are subject to arbitration on an individual (non-class, non-representative) basis, and the arbitrator may award relief only on an individual (non-class, non-representative) basis. This includes injunctive relief, which the arbitrator may award relief only on an individual, non-public basis, subject to subsection (e) below. The term “Claim” is to be given the broadest possible meaning that will be enforced. “Administrator” means the American Arbitration Association, 335 Madison Avenue, New York, NY 10017, www.adr.org, (800) 778-7879; or JAMS, 1920 Main St., Suite 300, Irvine, CA 92614, www.jamsadr.com, (949) 224-1810.

22.2 Right to Elect Arbitration

We or you have the right to require that each Claim be resolved by arbitration on an individual (non-class, non-representative) basis. A Claim will be arbitrated if (i) both we and you or (ii) only one or the other of we or you, exercise the right to require that the Claim be arbitrated. If, for example, we exercise our right to require that the Claim be resolved by arbitration, but you do not also exercise your right to require that the Claim be arbitrated, the Claim will be resolved by arbitration. If neither we nor you request arbitration, the Claim will not be resolved by arbitration and instead will be litigated in court. We will not elect arbitration for any Claim you file in small claims court, so long as the Claim is individual and pending only in that court. The Administrator’s authority to resolve Claims is limited to Claims between you and us alone, and the Administrator’s authority to make awards or decisions is limited to you and us alone. Furthermore, Claims between you and us may not be joined or consolidated in arbitration with Claims brought by or against someone other than you, unless otherwise agreed to in writing by all parties. However, corporate affiliates are considered one person for the purposes of this paragraph. No arbitration award will have any preclusive effect as to issues or claims in any dispute involving anyone who is not a party to the arbitration. This arbitration provision is made pursuant to a transaction involving interstate commerce and will be governed by the Federal Arbitration Act (the “FAA”) (9 U.S.C. §1, et seq.).

22.3 No Jury Trial or Class Claims

If we or you request arbitration of a Claim, we and you will not have the right to litigate the Claim in court. This means (i) there will be no jury trial on the Claim, (ii) there will be no pre-arbitration discovery except as the Administrator’s rules permit, and (iii) no Claim may be arbitrated on a class-action, private attorney general, or other representative basis, and neither we nor you will have the right to participate as a representative or member of any class or group of claimants pertaining to any Claim subject to arbitration. We or you may elect to arbitrate any Claim at any time unless it has been filed in court and trial has begun or final judgment has been entered.

22.4 Initiation of Arbitration

The party initiating an arbitration shall select an Administrator from the organizations listed above. If none of the Administrators listed above will accept the arbitration, the arbitration will be administered by an administrator, or adjudicated by an arbitrator, upon which you and we agree in writing (and in such event, the defined term Administrator shall include such other person). The arbitration shall be governed by the procedures and rules of the Administrator and this Agreement, which need not apply federal, state or local rules of procedure and evidence. The Administrator’s procedures and rules may limit the discovery available to you or us. You can obtain a copy of an Administrator’s procedures and rules by contacting the Administrator. A single, neutral arbitrator will resolve the Claims. The arbitrator will be either a lawyer with at least ten years’ experience or a retired or former judge, selected in accordance with the rules of the Administrator. In the event of any conflict or inconsistency between this arbitration provision and the Administrator's rules or other provisions of this Agreement, this arbitration provision will govern. The arbitrator will take reasonable steps to protect customer account information and other confidential information if requested to do so by you or us. Arbitration hearings for Claims by or against you will take place in the federal judicial district in which you reside. If you make a request to us in writing, we will temporarily advance to you the filing, administrative, and hearing fees for the arbitration of your Claim against us (but not if the Claim is against you) in excess of any filing fee you would have been required to pay to file the Claim in a state or federal court (whichever is less) in the judicial district in which you reside. At the end of the arbitration, the arbitrator will decide if you have to repay the advance (and if you do have to repay, you agree to do so). Unless applicable law requires otherwise, we will pay our, and you will pay your, lawyers’, experts’, and witnesses’ fees. The arbitrator will apply applicable substantive law consistent with the FAA and applicable statutes of limitations, will honor claims of privilege recognized at law, and will have the power to award to a party any damages or other relief provided for under applicable law. The arbitrator will make any award in writing and, if requested by you or us, will provide a brief statement of the reasons for the award.

22.5 Public Injunctive Relief

To the extent allowed by applicable law, you also waive your right to seek a public injunction if such a waiver is permitted by the FAA. However, this Arbitration Provision shall not be construed to prevent you from seeking in the arbitration the remedy of public injunctive relief if (a) you reside in California, (b) you resided in California at the time you entered into the Agreement, or (c) your billing address for this Loan is a California address. If you meet one of these conditions or if a court decides that such a public injunction waiver is not permitted, and that decision is not reversed on appeal, all other Claims will be decided in arbitration under this Arbitration Provision and your Claim for a public injunction then will be decided in court. In such a case the parties will request that the court stay the Claim for a public injunction until the arbitration award regarding individual relief has been entered in court. You agree that you will request such a stay when required. In no event will a claim for public injunctive relief be arbitrated.

22.6 Arbitration Award and Appeals

Judgment upon the arbitrator’s award may be entered in any court with jurisdiction. The arbitrator’s decision regarding any claims will be final and binding, except for any appeal right under FAA. The appealing party will pay the appeal costs. This Agreement to arbitrate shall survive any suspension, termination, revocation of the Agreement or your Card Account, and any bankruptcy to the extent consistent with applicable bankruptcy law.

22.7 Enforcement of this Arbitration Provision

If any part of this Arbitration Provision cannot be enforced, the rest of the arbitration provision will continue to apply. However, an arbitrator cannot enlarge his or her authority over the adjudication of Claims beyond that provided by this arbitration provision by enforcing only part of this arbitration provision. If an arbitrator determines that applicable law requires this Arbitration Provision to be enforced in a way that would result in greater authority over Claims than otherwise allowed, such as the adjudication of claims on a class or representative basis or other non-individual basis, then the arbitrator must decline to hear the dispute and shall refer the parties to a court or other body with sufficient authority. In the event of any conflict or inconsistency between this arbitration provision and the Administrator’s rules or other provisions of this Agreement, this Arbitration Provision will govern.

22.8 Opt-Out Right

You may reject this Arbitration Provision by mailing a signed rejection notice to [WebBank c/o Cleo AI Inc, 150 West 25th Street, RM 403, New York City, NY 10001 ] within thirty (30) calendar days of the date that you execute this Agreement. Your rejection notice must include the following information: your name, physical address, e-mail and address, and telephone number, and a statement that you are rejecting this Arbitration Provision.

Section 23: Force Majeure

Unless otherwise required by applicable law, we are not responsible and will not incur liability to you for any failure, error, malfunction or any delay in carrying out obligations under this Agreement if such failure, error or delay results from causes that are beyond our reasonable control (including, but not limited to inclement weather, fire, flood, acts of war or terrorism, and earthquakes).

Section 24: LIMITATION OF LIABILITY

TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW WEBBANK AND CLEO WILL NOT BE RESPONSIBLE, UNDER ANY CIRCUMSTANCES, TO YOU OR ANY THIRD PARTY FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL, EXEMPLARY, LIQUIDATED, OR PUNITIVE DAMAGES, INCLUDING DAMAGES UNDER WARRANTY, CONTRACT, TORT, NEGLIGENCE, OR ANY OTHER CLAIMS, ARISING OUT OF OR RELATING TO YOUR USE OF THE CARD ACCOUNT, EVEN IF WE OR CLEO HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES THE CLEO PARTIES WILL ALSO NOT BE LIABLE TO YOU FOR ANY

USE OF INFORMATION, DATA, OR OTHER MATERIAL TRANSMITTED VIA THE CLEO APPLICATIONS, CLEO WEBSITE, OR FOR ANY ERRORS, DEFECTS, INTERRUPTIONS, DELETIONS, OR LOSSES RESULTING FROM, INCLUDING LOSS OF PROFIT, REVENUE, OR BUSINESS, ARISING IN WHOLE OR IN PART FROM THE CLEO APPLICATIONS OR CLEO WEBSITE.

EACH PROVISION OF THIS AGREEMENT THAT PROVIDES FOR A LIMITATION OF LIABILITY, DISCLAIMER OF WARRANTIES, OR EXCLUSION OF DAMAGES IS INTENDED TO AND DOES ALLOCATE THE RISKS BETWEEN THE PARTIES UNDER THIS AGREEMENT. THIS ALLOCATION IS AN ESSENTIAL ELEMENT OF THE BASIS OF THE BARGAIN BETWEEN THE PARTIES. EACH OF THESE PROVISIONS IS SEVERABLE AND INDEPENDENT OF ALL OTHER PROVISIONS OF THIS AGREEMENT. THE LIMITATIONS IN THIS AGREEMENT WILL APPLY EVEN IF ANY LIMITED REMEDY FAILS OF ITS ESSENTIAL PURPOSE.

Section 25: Change in Terms

Subject to the limitations of applicable law, we may at any time change, add to, or delete any of the terms and conditions in this Agreement. We will give you notice of any change, addition, or deletion as required by applicable law. Such changed terms will apply to new transactions and to the outstanding balance of your Card Account as of the effective date, to the extent permitted by applicable law.

Section 26. Severability

If any provision of this Agreement is determined to be void or unenforceable under any applicable law, rule or regulation, all other provisions of this Agreement will remain enforceable.

Section 27. Entire Agreement

This Agreement, including all documents incorporated by reference, constitutes, and contains the entire agreement between you and us with respect to the matters addressed in the Agreement and supersedes any prior or contemporaneous oral or written agreements.